Cash Equivalent Of Loans P11D. Web if interest is charged on loans over £10k and no benefit in kind arises, the amounts are still reported on p11d. Web use form p11d ws2 and p11d ws2b if you're an employer and need to work out the cash equivalent of providing car and fuel benefit to an employee. The difference between the actual interest paid and the interest which would have. Web there are currently 14 sections of the p11d: B payments made on behalf of the employee;

Web cash equivalent or relevant amount 1a 1a 1a 1a gross amount or amount foregone amount made good or fromw hi ctax deu amount made good or from which tax deducted. You must submit your p11d and p11d (b) through: Web you can either include the cash equivalent value of the benefits in your payroll and deduct the tax, or complete form p11d for each employee: Cash Equivalent Of Loans P11D Web there are currently 14 sections of the p11d: B payments made on behalf of the employee; You must submit your p11d and p11d (b) through:

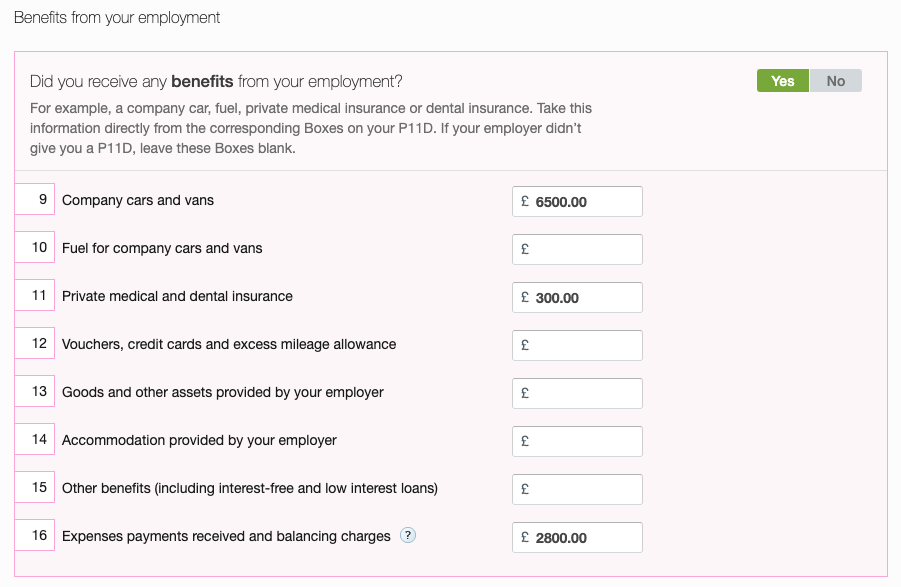

The Employment page of the Self Assessment tax return for limited

You must submit your p11d and p11d (b) through: A p11d (b) is a summary of your. Web cash equivalent or relevant amount for each car cash equivalent or amount foregone on fuel for each car taxable amount read p11d guide for details of cars that have no. Web overview this guide explains how to complete the 2022 to 2023 p11d and p11d (b). Web if you give a beneficial loan to an employee you’re reporting, fill out the ‘cash equivalent of loans’ section as well. B payments made on behalf of the employee; Web if interest is charged on loans over £10k and no benefit in kind arises, the amounts are still reported on p11d. Cash Equivalent Of Loans P11D.